Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Statement No. 333-272524

Dated June 9, 2023

(To Preliminary Prospectus dated June 8, 2023)

Free Writing Prospectus

MAIA Biotechnology, Inc.

This free writing prospectus relates to the proposed public offering of shares of common stock, par value $0.0001 of MAIA Biotechnology, Inc. (the “Company”), which are being registered on a Registration Statement on Form S-1, as amended (No. 333-272524) (the “Registration Statement”). This free writing prospectus should be read together with the preliminary prospectus dated June 8, 2023 included in that Registration Statement, which can be accessed through the following link:

https://www.sec.gov/ix?doc=/Archives/edgar/data/1878313/000119312523163582/d476138ds1.htm

We have filed the Registration Statement with the Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the preliminary prospectus in the Registration Statement (including the risk factors described therein) and other documents we have filed with the SEC for more complete information about our Company and this offering. You may access these documents for free by visiting EDGAR on the SEC Web site at http://www.sec.gov. Alternatively, we or any underwriter participating in the offering will arrange to send you the prospectus if you contact ThinkEquity, Prospectus Department, 17 State Street, 41st Floor, New York, New York 10004, telephone: (877) 436-3673 or e-mail: prospectus@think-equity.com.

TELOMERE TARGETING IMMUNOTHERAPIES FOR CANCER NYSE AMERICAN: MAIA June 2023

FREE WRITING PROSPECTUS This presentation highlights basic information about us and the proposed offering. Because it is a summary, it does not contain all of the information that you should consider before investing. We have filed a registration statement (including a prospectus) with the SEC for the offering to which this presentation relates. The registration statement has not yet become effective. Before you invest, you should read the prospectus in the registration statement (including the risk factors described therein) and other documents we have filed with the SEC for more complete information about us and the offering. You may access these documents for free by visiting EDGAR on the SEC Web site at http://www.sec.gov. Alternatively, we or any underwriter participating in the offering will arrange to send you the prospectus if you contact ThinkEquity, Prospectus Department, 17 State Street, 41st Floor, New York, New York 10004, telephone: (877) 436-3673 or e-mail: prospectus@think- equity.com. This presentation shall not constitute an offer to sell, or the solicitation of an offer to buy, nor will there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. The offering will only be made by means of a prospectus pursuant to a registration statement that is filed with the SEC after such registration statement becomes effective. 2

FORWARD-LOOKING STATEMENTS All statements in this presentation, other than those relating to historical facts, are forward-looking statements. These forward-looking statements may include, but are not limited to, statements relating to our objectives, plans, and strategies; statements that contain projections of results of operations or of financial condition; statements relating to the industry and government policies and regulations relating to our industry; and all statements (other than statements of historical facts) that address activities, events, or developments that we intend, expect, project, believe, or anticipate will or may occur in the future. Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments, and other factors they believe to be appropriate. Important factors that could cause actual results, developments, and business decisions to differ materially from those anticipated in these forward-looking statements include, among other things: the overall global economic environment; general market, political, and economic conditions in the countries in which we operate: projected capital expenditures and liquidity; changes in our strategy; government regulations and approvals; the application of certain service license; and litigation and regulatory proceedings. The Company has filed a registration statement on Form S-1, as may be amended (Registration No.: 333-272524). Before you invest, you should carefully read the registration statement, including the factors described in the “RISK FACTORS” section of the Registration Statement and other documents that we have filed, and will subsequently file, with the Securities and Exchange Commission to better understand the risks and uncertainties inherent in our business and industry and for more complete information about us and the offering. You may get these documents for free by visiting EDGAR on the Commission's website at www.sec.gov. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward-looking statements contained in this presentation as a result of, among other factors, the factors referenced in the Risk Factors” section of the Registration Statement. In addition, even if our results of operations, financial condition and liquidity, and the development of the industry in which we operate are consistent with the forward-looking statements contained in this presentation, they may not be predictive of results or developments in future periods. This presentation shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any of our securities nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Any offering of securities can only be made in compliance with applicable securities laws. You should read carefully the factors described in the “Risk Factors section of the Registration Statement to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements. These statements are only current predictions and are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry's actual results, levels of activity, performance, or achievements to be materially different from those anticipated by the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Except as required by law, we are under no duty to update or revise any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this prospectus. These forward-looking statements speak only as of the date of this presentation, and we assume no obligation to update or revise these forward-looking statements for any reason. 3

INVESTMENT OVERVIEW • Telomere-Targeting Agents: o THIO in clinic o Advancing pipeline • Efficacy • Safety • FDA: 2 Orphan Drug Designations (HCC and SCLC) • REGN: Clinical Supply Agreement • Phase 2 Go-to-Market Accelerated Approval THIO-101 trial in NSCLC underway o Enrolling in AUS and EU o On track to open sites in US in 2023 o Upcoming Milestones: Safety, ORR, DoR • Phase 2 Go-to-Market Accelerated Approval THIO-102 basket/umbrella trial in 2023 4 4 • Phase 2/3 Confirmatory/Expansion THIO-103 basket trial in 2023

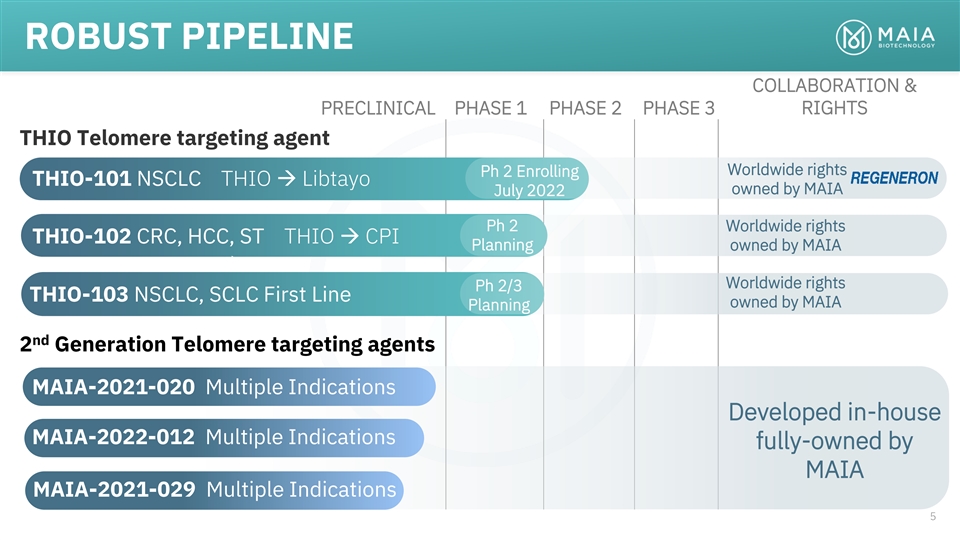

ROBUST PIPELINE COLLABORATION & PRECLINICAL PHASE 1 PHASE 2 PHASE 3 RIGHTS THIO Telomere targeting agent Worldwide rights Ph 2 Enrolling THIO-101 NSCLC THIO → Libtayo owned by MAIA July 2022 Ph 2 Worldwide rights THIO-102 CRC, HCC, ST THIO → CPI Planning owned by MAIA Worldwide rights Ph 2/3 THIO-103 NSCLC, SCLC First Line owned by MAIA Planning nd 2 Generation Telomere targeting agents MAIA-2021-020 Multiple Indications Developed in-house MAIA-2022-012 Multiple Indications fully-owned by MAIA MAIA-2021-029 Multiple Indications 5

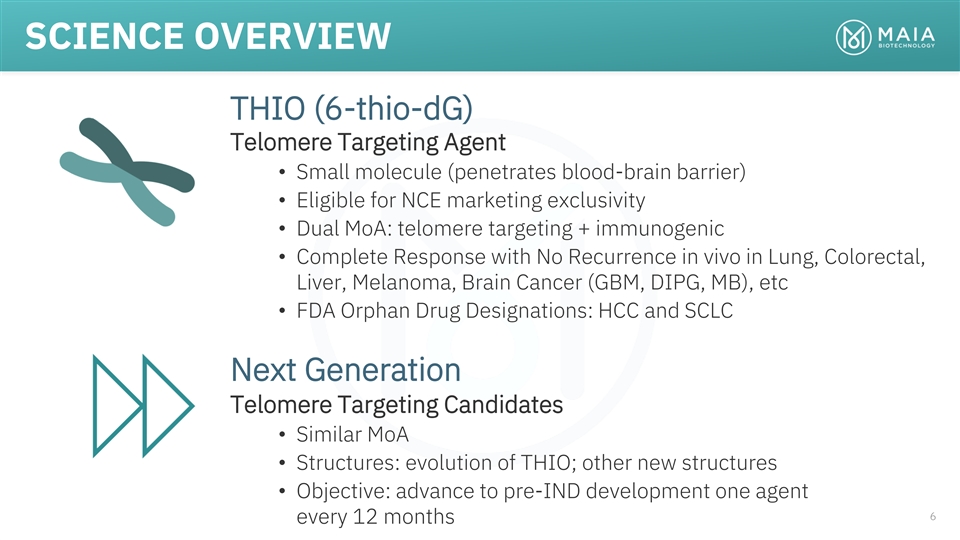

SCIENCE OVERVIEW THIO (6-thio-dG) Telomere Targeting Agent • Small molecule (penetrates blood-brain barrier) • Eligible for NCE marketing exclusivity • Dual MoA: telomere targeting + immunogenic • Complete Response with No Recurrence in vivo in Lung, Colorectal, Liver, Melanoma, Brain Cancer (GBM, DIPG, MB), etc • FDA Orphan Drug Designations: HCC and SCLC Next Generation Telomere Targeting Candidates • Similar MoA • Structures: evolution of THIO; other new structures • Objective: advance to pre-IND development one agent 6 every 12 months

MISSION AND APPROACH 7 7

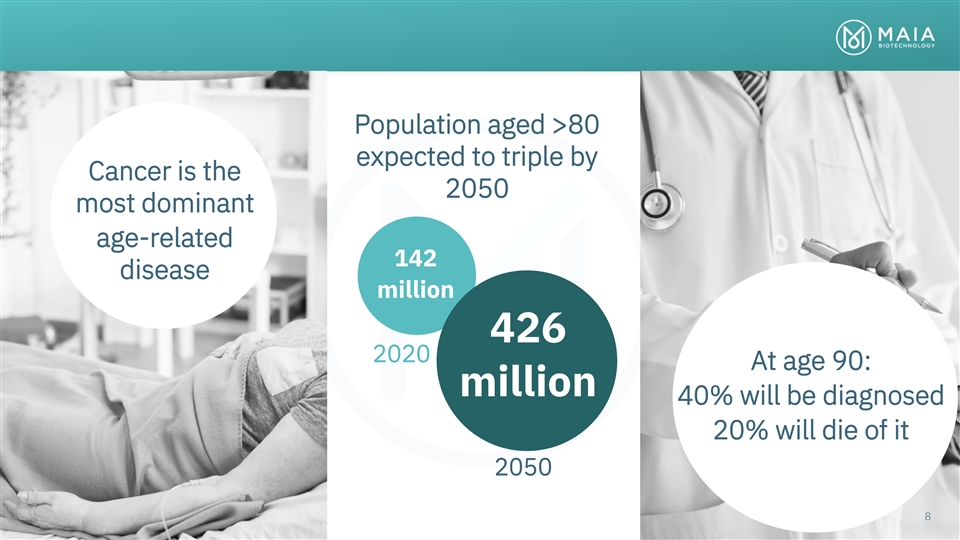

Population aged >80 expected to triple by Cancer is the 2050 most dominant age-related 142 disease million 426 Cancer is the most dominant of the age-related disease categories and has 2020 At age 90: life altering impacts in the lives of patients and their close ones million 40% will be diagnosed 20% will die of it 2050 88

THIO is the only direct telomere targeting agent currently in clinical development 99

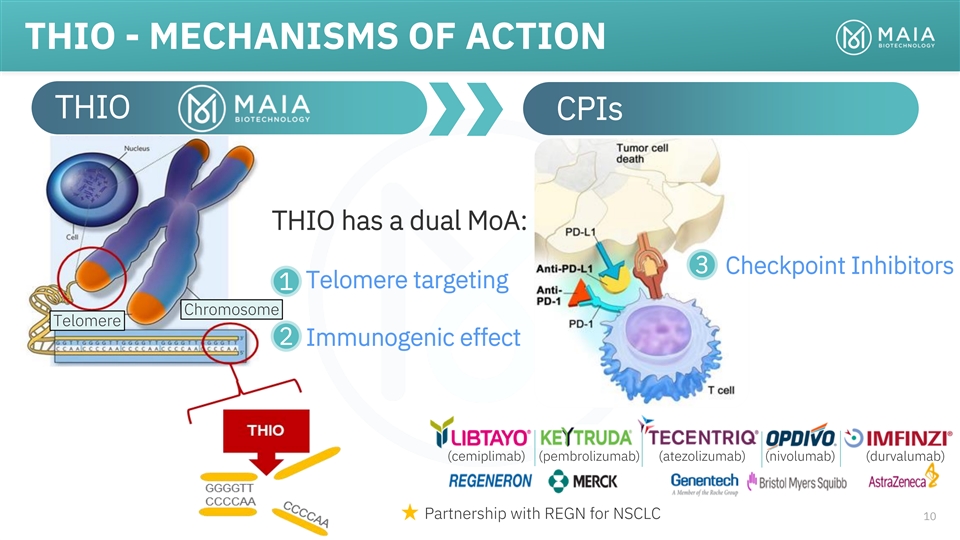

THIO - MECHANISMS OF ACTION THIO CPIs THIO has a dual MoA: 3 Checkpoint Inhibitors Telomere targeting 1 Chromosome Telomere 2 Immunogenic effect (cemiplimab) (pembrolizumab) (atezolizumab) (nivolumab) (durvalumab) Partnership with REGN for NSCLC 10

REGENERON AGREEMENT & 11

THIO-101 TRIAL (ONGOING) A Multicenter, Open-Label, Dose-Finding Phase 2 Trial Evaluating the Safety and Efficacy of THIO Administered in Sequence with LIBTAYO® (cemiplimab) Part A: Safety Part B: Efficacy / Safety / Part C*: Dose Selection Registration Currently enrolling Every 3 Weeks THIO 60mg (N=19) N ≤ 41 Expand best NSCLC ORR, ORR, THIO 180mg THIO cemiplimab per dose arm to (N=19) 360mg DCR DoR 2L+ Arm N = 100-120 THIO 360mg (N=19) Primary Endpoints Safety, ORR DCR (CR, PR and SD); DoR; PFS; OS Secondary Endpoints PK and PD (activity of THIO in circulating tumor cells measured by specific biomarkers) Exploratory Endpoints ClinicalTrials.gov: https://clinicaltrials.gov/ct2/show/NCT05208944?term=05208944&draw=2&rank=1 *Would require FDA agreement 12 Immune Activation RANDOMIZE

FAVORABLE SAFETY PROFILE • Safety events reported during dose-limiting toxicity window • 360 mg/cycle – THIO highest dose • Data from 6 patients who completed the dose-limiting toxicity (DLT) period in Cycle 1 (3 weeks) • No Serious Adverse Events (SAE) or Serious Unexpected Suspected Adverse Reactions (SUSAR) • Safety profile substantially better than current standard of care • Chemotherapy has 70-80% incidence of grade 3-4 very severe side effects • Started Part B (efficacy/dose selection) of the trial upon recommendation by the Safety Review Committee 13

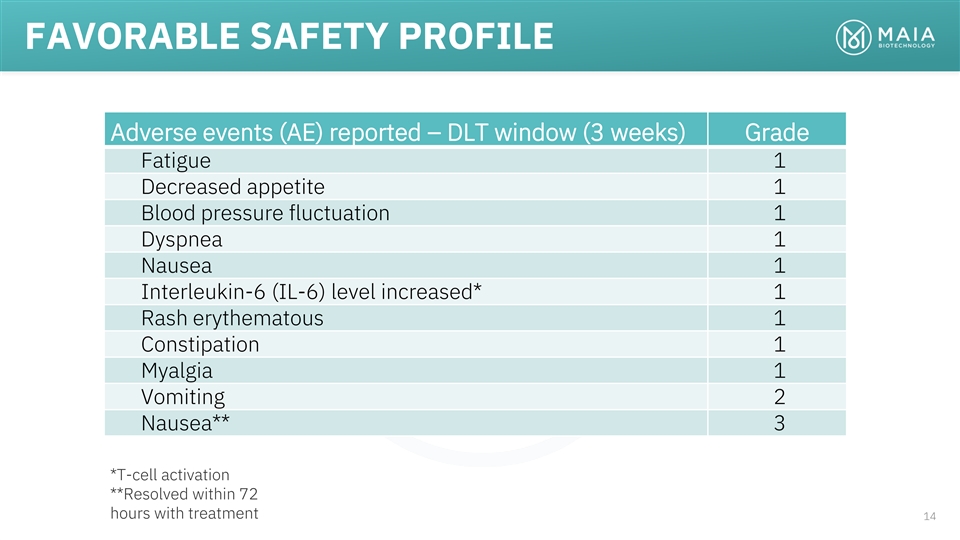

FAVORABLE SAFETY PROFILE Adverse events (AE) reported – DLT window (3 weeks) Grade Fatigue 1 Decreased appetite 1 Blood pressure fluctuation 1 Dyspnea 1 Nausea 1 Interleukin-6 (IL-6) level increased* 1 Rash erythematous 1 Constipation 1 Myalgia 1 Vomiting 2 Nausea** 3 *T-cell activation **Resolved within 72 hours with treatment 14

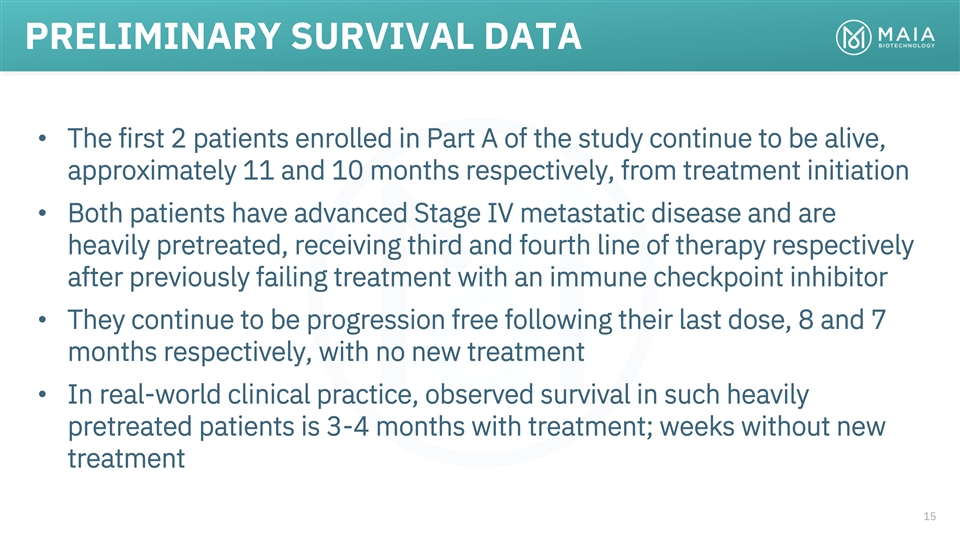

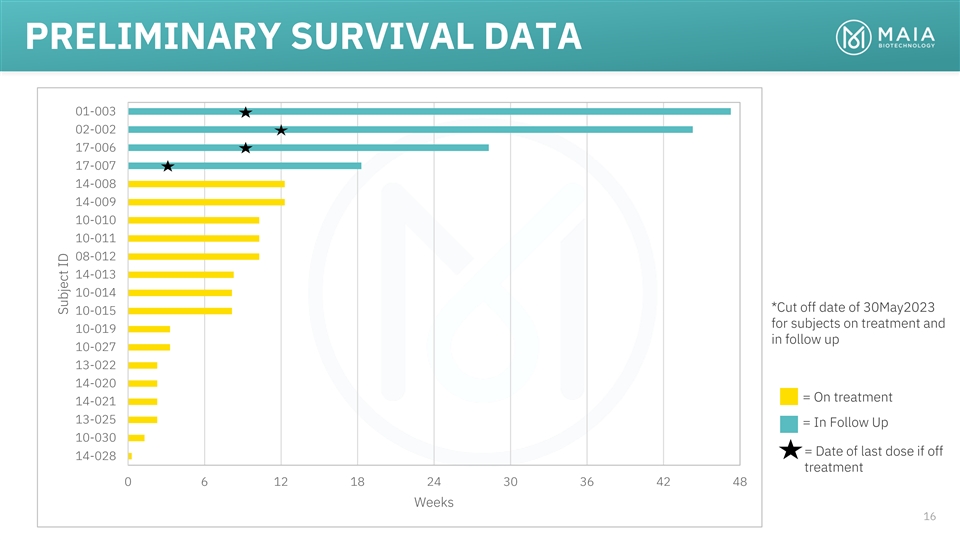

PRELIMINARY SURVIVAL DATA • The first 2 patients enrolled in Part A of the study continue to be alive, approximately 11 and 10 months respectively, from treatment initiation • Both patients have advanced Stage IV metastatic disease and are heavily pretreated, receiving third and fourth line of therapy respectively after previously failing treatment with an immune checkpoint inhibitor • They continue to be progression free following their last dose, 8 and 7 months respectively, with no new treatment • In real-world clinical practice, observed survival in such heavily pretreated patients is 3-4 months with treatment; weeks without new treatment 15

PRELIMINARY SURVIVAL DATA 01-003 02-002 17-006 17-007 14-008 14-009 10-010 10-011 08-012 14-013 10-014 *Cut off date of 30May2023 10-015 for subjects on treatment and 10-019 in follow up 10-027 13-022 14-020 = On treatment 14-021 13-025 = In Follow Up 10-030 = Date of last dose if off 14-028 treatment 0 6 12 18 24 30 36 42 48 Weeks 16 Subject ID

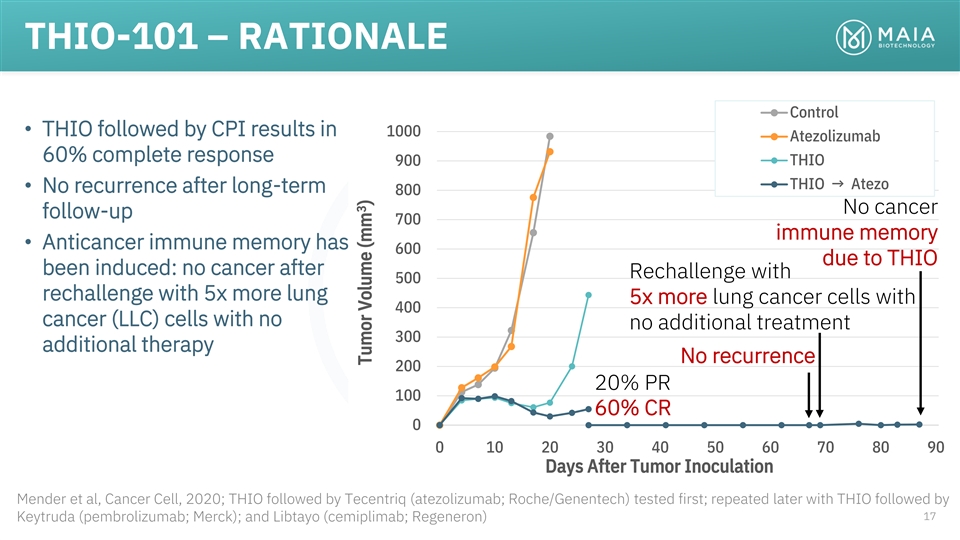

THIO-101 – RATIONALE Control • THIO followed by CPI results in 1000 Atezolizumab 60% complete response THIO 900 THIO → Atezo • No recurrence after long-term 800 No cancer follow-up 700 immune memory • Anticancer immune memory has 600 due to THIO been induced: no cancer after Rechallenge with 500 rechallenge with 5x more lung 5x more lung cancer cells with 400 cancer (LLC) cells with no no additional treatment 300 additional therapy No recurrence 200 20% PR 100 60% CR 0 0 10 20 30 40 50 60 70 80 90 Days After Tumor Inoculation Mender et al, Cancer Cell, 2020; THIO followed by Tecentriq (atezolizumab; Roche/Genentech) tested first; repeated later with THIO followed by 17 Keytruda (pembrolizumab; Merck); and Libtayo (cemiplimab; Regeneron) 3 Tumor Volume (mm )

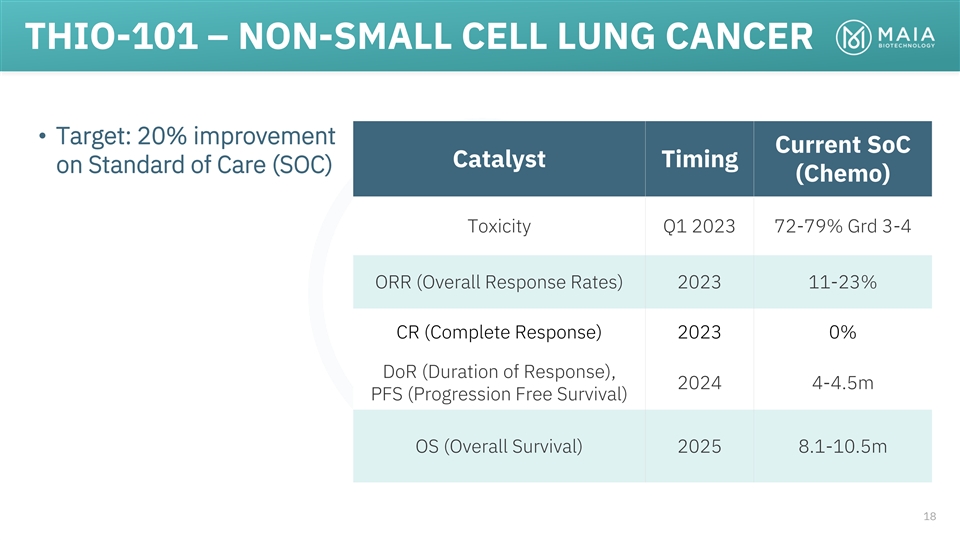

THIO-101 – NON-SMALL CELL LUNG CANCER • Target: 20% improvement Current SoC Catalyst Timing on Standard of Care (SOC) (Chemo) Toxicity Q1 2023 72-79% Grd 3-4 ORR (Overall Response Rates) 2023 11-23% CR (Complete Response) 2023 0% DoR (Duration of Response), 2024 4-4.5m PFS (Progression Free Survival) OS (Overall Survival) 2025 8.1-10.5m 18

BIOMARKER – TIFS (TELOMERE DYSFUNCTION INDUCED FOCI) Confocal microscopy image of LLC cell Quantification of TIFs induced nucleus after treatment with THIO in LLC cell by 3 µM of THIO DAPI γH2AX Tel C THIO • Yellow dots indicated TIFs by THIO • TIFs induction reached max after ~ 48h • Green dots - γH2AX • Formation of TIFs indicated on-target MOA of 19 • Red dots - telomeres THIO

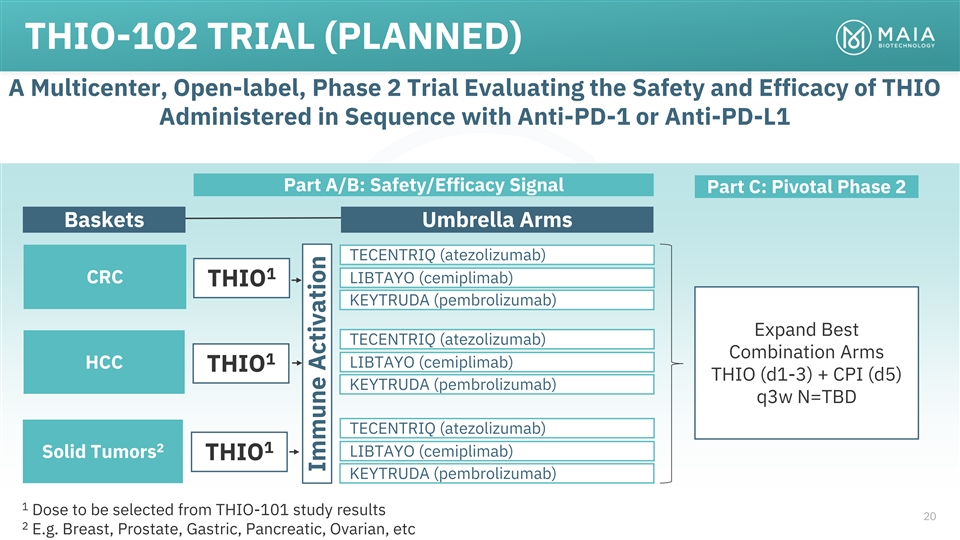

THIO-102 TRIAL (PLANNED) A Multicenter, Open-label, Phase 2 Trial Evaluating the Safety and Efficacy of THIO Administered in Sequence with Anti-PD-1 or Anti-PD-L1 Part A/B: Safety/Efficacy Signal Part C: Pivotal Phase 2 Baskets Umbrella Arms TECENTRIQ (atezolizumab) 1 CRC LIBTAYO (cemiplimab) THIO KEYTRUDA (pembrolizumab) Expand Best TECENTRIQ (atezolizumab) Combination Arms 1 LIBTAYO (cemiplimab) HCC THIO THIO (d1-3) + CPI (d5) KEYTRUDA (pembrolizumab) q3w N=TBD TECENTRIQ (atezolizumab) 2 1 LIBTAYO (cemiplimab) Solid Tumors THIO KEYTRUDA (pembrolizumab) 1 Dose to be selected from THIO-101 study results 20 2 E.g. Breast, Prostate, Gastric, Pancreatic, Ovarian, etc Immune Activation

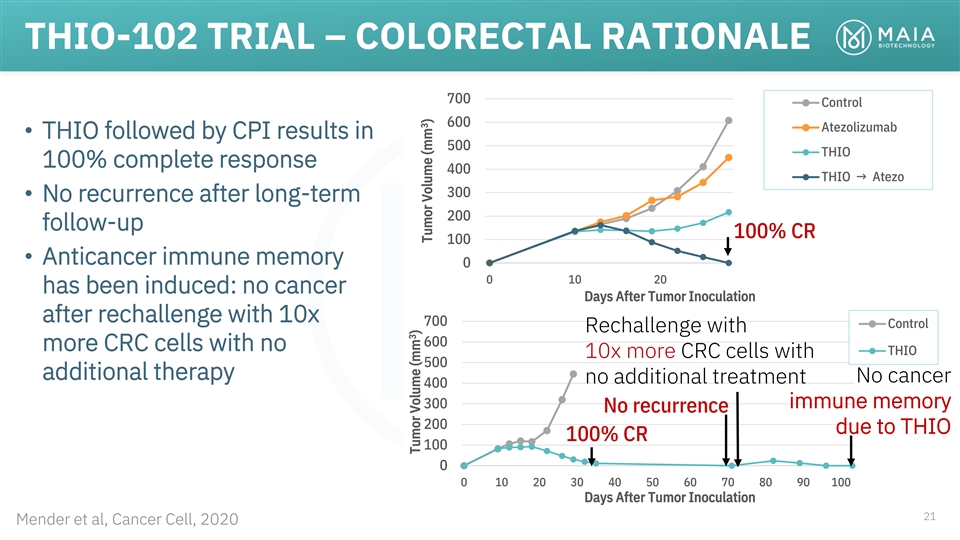

THIO-102 TRIAL – COLORECTAL RATIONALE 700 Control 600 Atezolizumab • THIO followed by CPI results in 500 THIO 100% complete response 400 THIO → Atezo 300 • No recurrence after long-term 200 follow-up 100% CR 100 • Anticancer immune memory 0 0 10 20 has been induced: no cancer Days After Tumor Inoculation after rechallenge with 10x 700 Control Rechallenge with 600 more CRC cells with no THIO 10x more CRC cells with 500 additional therapy No cancer no additional treatment 400 300 immune memory No recurrence 200 due to THIO 100% CR 100 0 0 10 20 30 40 50 60 70 80 90 100 Days After Tumor Inoculation 21 Mender et al, Cancer Cell, 2020 3 Tumor Volume (mm ) 3 Tumor Volume (mm )

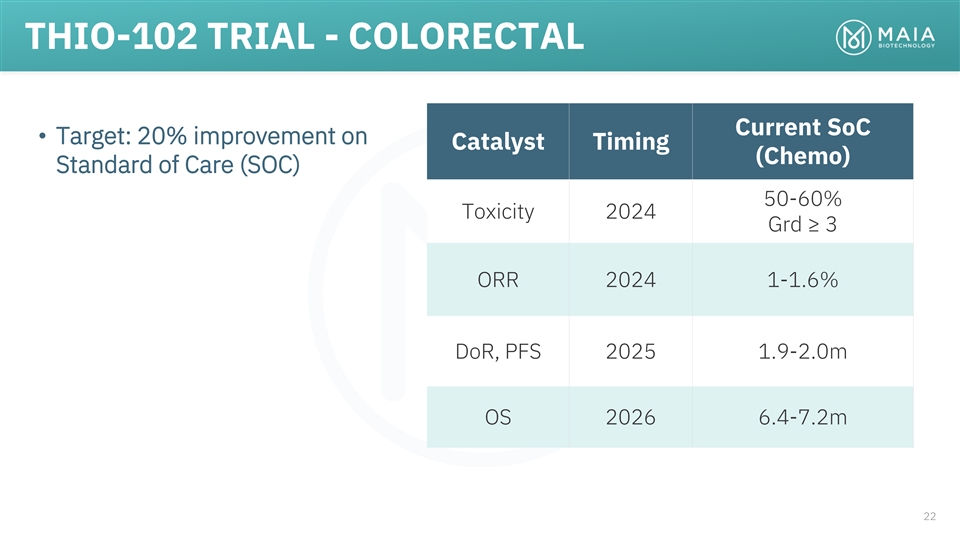

THIO-102 TRIAL - COLORECTAL Current SoC • Target: 20% improvement on Catalyst Timing (Chemo) Standard of Care (SOC) 50-60% Toxicity 2024 Grd ≥ 3 ORR 2024 1-1.6% DoR, PFS 2025 1.9-2.0m OS 2026 6.4-7.2m 22

SCLC & HCC – ORPHAN DRUG DESIGNATION HCC SCLC 1500 1500 Control Control 1250 1250 THIO Pembro → THIO 1000 1000 THIO → IR THIO → Pembro 750 750 IR + Atezo THIO → IR + Atezo 500 500 250 250 0 0 0 5 10 15 20 25 0 5 10 15 20 25 Days After Tumor Inoculation Days After Tumor Inoculation • THIO is synergistic with anti-PD-1 agent Pembrolizumab in • THIO is highly synergistic and effective in combination with Small Cell Lung Carcinoma (H2081) in vivo in humanized anti-PD-L1 agent Atezolizumab and Ionizing Radiation (IR murine cancer model. 10Gy) in HCC53N Hepatocellular Carcinoma. • Treatment with THIO followed by Pembrolizumab results in • Treatment with THIO in combination with IR and highly potent anticancer effect, as compared to Atezolizumab results in a complete regression of Pembrolizumab alone. aggressive HCC tumors. The combination of IR and Atezolizumab is just partially efficacious. • THIO converts immunologically “cold non-responsive” SCLC tumor into “hot and responsive” to Pembrolizumab. 23 3 Tumor Volume (mm ) 3 Tumor Volume (mm )

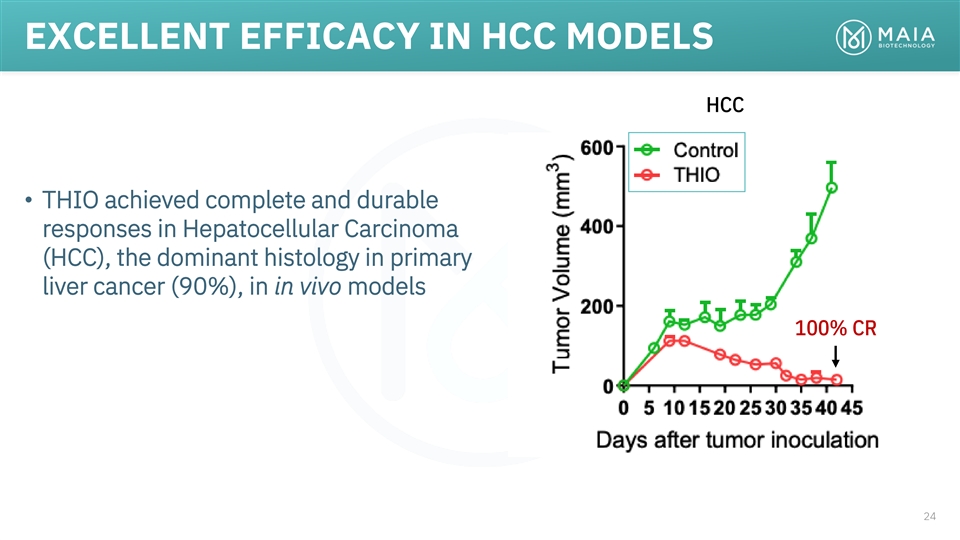

EXCELLENT EFFICACY IN HCC MODELS HCC • THIO achieved complete and durable responses in Hepatocellular Carcinoma (HCC), the dominant histology in primary liver cancer (90%), in in vivo models 100% CR 24

HCC ANTI-CANCER IMMUNE MEMORY HCC • When combined with immunotherapy checkpoint inhibitor Libtayo®, duration of response was further potentiated • Upon rechallenge with two times more cancer cells and no additional treatment, tumor growth HCC Rechallenge with was completely prevented 2x more HCC cells with no additional treatment No cancer • Administration of THIO alone and immune memory in combination with Libtayo® due to THIO generated anti-cancer immune memory 25

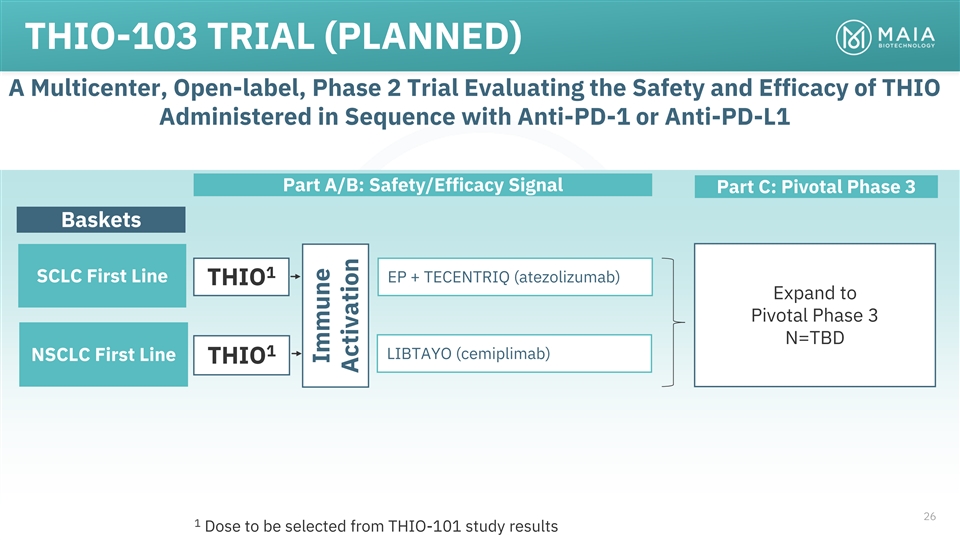

THIO-103 TRIAL (PLANNED) A Multicenter, Open-label, Phase 2 Trial Evaluating the Safety and Efficacy of THIO Administered in Sequence with Anti-PD-1 or Anti-PD-L1 Part A/B: Safety/Efficacy Signal Part C: Pivotal Phase 3 Baskets 1 SCLC First Line EP + TECENTRIQ (atezolizumab) THIO Expand to Pivotal Phase 3 N=TBD 1 LIBTAYO (cemiplimab) NSCLC First Line THIO 26 1 Dose to be selected from THIO-101 study results Immune Activation

EXCLUSIVITY AND INTELLECTUAL PROPERTY Goal: New Chemical Entity (NCE) Marketing Exclusivity • THIO has never been previously approved by the FDA for commercialization • Robust exclusivity • US: 7 years; EU, Japan, other markets: 10 years Robust and Growing Patent Portfolio for THIO • 1 issued US patent • 4 issued foreign patents • 5 pending US patent applications • 7 pending foreign patent applications Current patents/provisional applications broadly cover the following key areas: • Telomere targeting compounds (2034+) • THIO’s immunogenic treatment strategy: sequential combination with CPIs (2041) 27

EXPERIENCED MANAGEMENT TEAM Vlad Vitoc, MD, MBA Mihail Obrocea, MD Sergei Gryaznov, PhD Joe McGuire Founder, Chairman, and Chief Medical Officer Chief Scientific Officer Chief Financial Officer Chief Executive Officer • 22+ years in Oncology Pharma/ • Hematologist/Oncologist • 25+ years as Scientist • 30+ years of financial Biotech: Commercial, Medical • Expert Drug Discovery and executive expertise • 12 compounds launched • 21+ years of drug Development, Oncology with • CFO for privately held across 20+ tumor types development experience: 120+ publications and publicly traded • Leadership roles at Bayer cell therapy, active • Head of the J&J Oligonucleotide companies in the (Nexavar), Astellas (Tarceva, immunotherapy and cancer Center of Excellence Worldwide healthcare and other Xtandi), Cephalon (Treanda), • Expert of telomeres and vaccines, antibodies, industries Novartis (Zometa), and Incyte antibody drug conjugates telomerase in cancer, co- (Jakafi) (ADCs), small molecules inventor of THIO 28

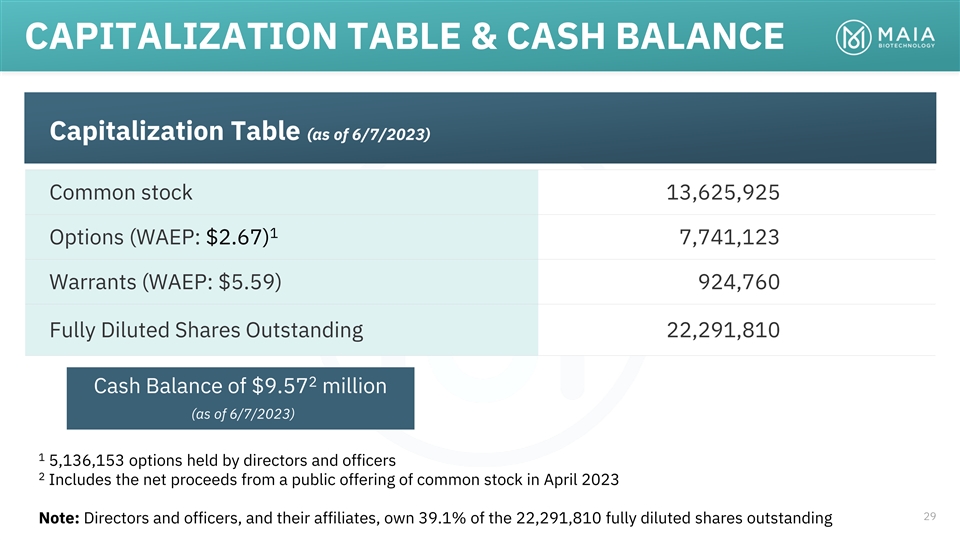

CAPITALIZATION TABLE & CASH BALANCE Capitalization Table (as of 6/7/2023) Common stock 13,625,925 1 Options (WAEP: $2.67) 7,741,123 Warrants (WAEP: $5.59) 924,760 Fully Diluted Shares Outstanding 22,291,810 2 Cash Balance of $9.57 million (as of 6/7/2023) 1 5,136,153 options held by directors and officers 2 Includes the net proceeds from a public offering of common stock in April 2023 29 Note: Directors and officers, and their affiliates, own 39.1% of the 22,291,810 fully diluted shares outstanding

INVESTMENT OPPORTUNITY 30 30

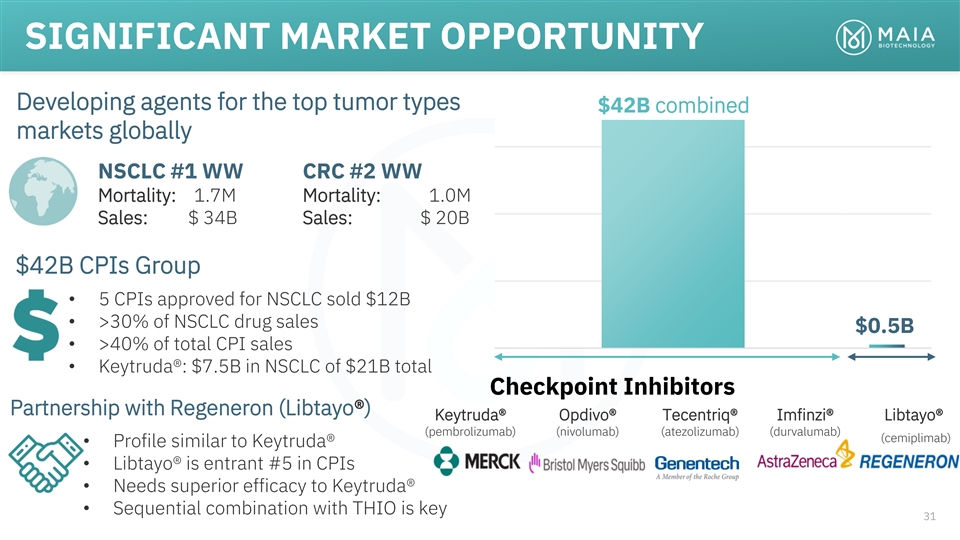

SIGNIFICANT MARKET OPPORTUNITY Developing agents for the top tumor types $42B combined markets globally NSCLC #1 WW CRC #2 WW Mortality: 1.7M Mortality: 1.0M Sales: $ 34B Sales: $ 20B $42B CPIs Group • 5 CPIs approved for NSCLC sold $12B • >30% of NSCLC drug sales $0.5B • >40% of total CPI sales Category 1 Category 1 • Keytruda®: $7.5B in NSCLC of $21B total Checkpoint Inhibitors Partnership with Regeneron (Libtayo®) Keytruda® Opdivo® Tecentriq® Imfinzi® Libtayo® (pembrolizumab) (nivolumab) (atezolizumab) (durvalumab) (cemiplimab) • Profile similar to Keytruda® • Libtayo® is entrant #5 in CPIs • Needs superior efficacy to Keytruda® • Sequential combination with THIO is key 31

COMPARABLE COMPANIES $34M $2.4B $1.5B $1.8B $0.9B $4.1B • On June 3, 2022, Bristol Myers Squibb announced the acquisition of Turning Point Therapeutics in an all-cash transaction for $4.1B in equity value. 32 32 Market Caps as of June 6, 2023 (source: S&P CapitalIQ)

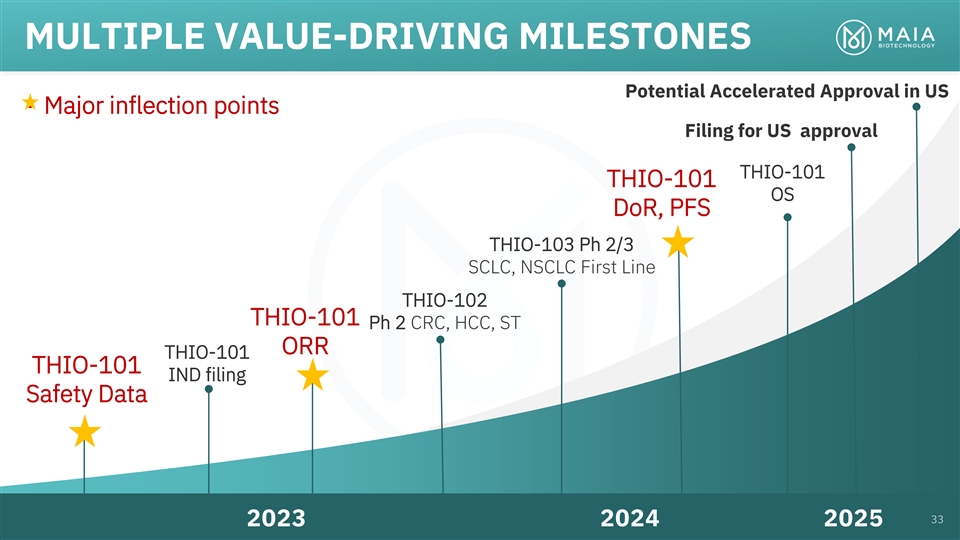

MULTIPLE VALUE-DRIVING MILESTONES Potential Accelerated Approval in US • Major inflection points Filing for US approval THIO-101 THIO-101 OS DoR, PFS THIO-103 Ph 2/3 SCLC, NSCLC First Line THIO-102 THIO-101 Ph 2 CRC, HCC, ST ORR THIO-101 THIO-101 IND filing Safety Data 33 33 2023 2024 2025

MAIA BIOTECHNOLOGY LISTED NYSE: MAIA July 28, 2022 34